On the vibrant international financial world, the brand new growing method of getting Sharia-certified potential gets a critical solution to possess Muslims global. Islamic Forex membership lose which concern by giving people with an excellent swap-totally free ecosystem. In these accounts, investors refrain from towering attention or swap charge, thus permitting them to participate in this market as opposed to contravening the spiritual convictions.

If not it is fundamentally thought halal, though there is distinctions out of opinions involved. Traditionally, retail Forex brokers create to change to have attention differentials inside the money sets to possess positions held straight away. Addressing market pushes and also the demands of, Islamic investors, of a lot agents transformed into “Islamic Fx Brokers,” launching “Muslim Forex Membership” one to steer clear of interest money. Some display concerns about factors including excessive suspicion (‘gharar’) and also the engagement of interest (‘riba’) in the immediately positions, indicating incompatibility which have Islamic beliefs.

Making decisions, especially in economic issues, comes to a mixture of intelligence and you may expertise. However, it’s important to note that Islam strictly forbids gaming, whether or not it’s just for enjoyable having small amounts of money. Fx brokers aren’t participate in transactions that are included with immediately interest payments, called change profits.

Hand-to-Hands Halal Exchange: dotbig broker

In dotbig broker your search for the proper Islamic Forex membership, remain these considerations in mind. Constantly go for a merchant account one aligns together with your ethical thinking and you can investment desires, now offers visibility, and that is backed by a professional broker. By using these procedures, you’ll generate advised choices that fit your financial requires.

For individuals who’lso are especially trying to an enthusiastic Islamic Fx membership, it’s wanted to ensure that the account it is aligns with Sharia principles. Investigate membership’s small print carefully to confirm which abides by such principles, since it is a simple aspect of including accounts. Islamic Fx accounts also are labeled as change-free otherwise Sharia-agreeable account. Go out change is viewed as haram if it relates to speculative conclusion and an excessive amount of chance, which happens from the prices out of Islamic money.

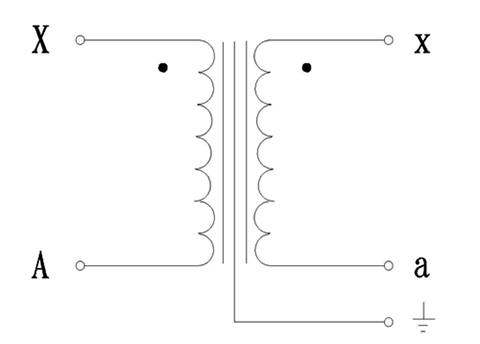

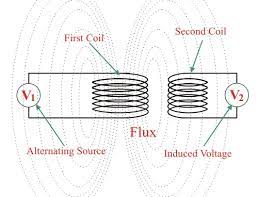

Forex, quick to possess forex, requires the exchange of different national currencies. Buyers attempt to cash in on the new motion inturn prices, to buy currencies in the a low speed and offering if the really worth increases. Yet not, while this may sound simple, Fx trading’s reality is described as high risk and you can volatility, also it can oppose several Islamic financing principles. Islamic finance are led by Shariah legislation, and therefore forbids particular issues for example charging you focus (riba) and you will entering speculative betting. To determine whether trading forex are halal or haram, it’s important to know the underlying principles from Islamic fund and how they apply to forex trading.

Come across a brokerage that has a substantial history, is managed, and contains a strong reputation in the industry. For those who deal with an established representative, you will get trust your opportunities and you may transactions have secure hands. Really, even though you do not go after Islamic finance values, Islamic Forex profile can provide you with moral and you may standard advantages. The absence of exchange charge and you can a connection so you can transparent, ethical using build this type of profile an appealing choice for anybody who thinking fairness and you may profits inside their opportunities.

Are The forex market Halal or Haram? An intensive Expertise to possess Muslim Investors

I am aware one dealing with the regular Forex program comes to riba or other infractions, and it is blocked while the is mentioned from the Fiqh Council. My matter is because of talking about the fresh Islamic Fx, which also has some infractions, but there is zero blatant riba doing work in they. All I actually do there is certainly an individual form of company because of the which i benefit, that’s to purchase silver if it is cheaper and you can attempting to sell they when it is costly, and that i profit because of the difference in price. I really don’t deal with other things, but We build a lot of make the most of you to definitely.

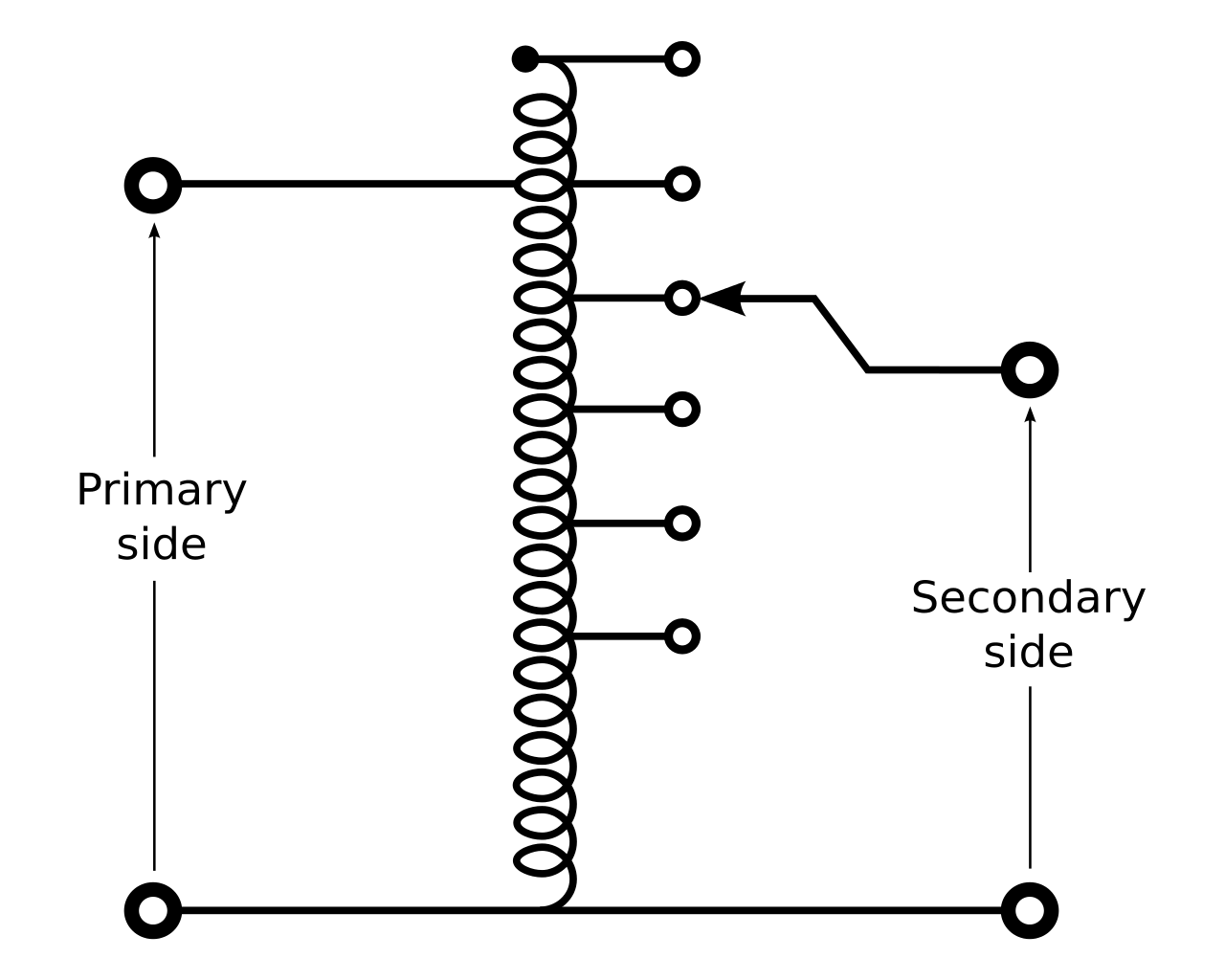

Knowledge Islamic Fx Account

Trading indices can be thought permissible inside the Islam so long as they abides by Sharia principles and you can avoids interest-dependent purchases. Buyers align their ranks to your assistance of your development, aiming to trip the fresh energy to possess effective effects. Trend-after the procedures have a tendency to play with tech signs to verify pattern power and possible reversals. As far as foreign currency are involved, they are both thought to be unspecific commodities. And that, in the case of online forex, because the each other transfers are deferred, which exchange is invalid and you can impermissible inside Islam. Furthermore, within the a great Fx trade, a trade commission try recharged when an investor holds on to an open position straight away.

As a result Muslim buyers is always to end change within the companies or markets which can be doing work in things banned by the Shariah legislation, such alcoholic beverages, gambling, and you may chicken-related things. Fx buyers should also abstain from stepping into unethical techniques such since the insider trading otherwise industry control. Just before going on the the forex market, you should and get a strong knowledge of the fresh fx industry, change actions, and you may chance management process.

Inside the trading, brief attempting to sell relates to wanting to profit from a decline inside the stock really worth. People manage acquire offers, sell him or her, shell out desire to your lender, and you can make an effort to pick equivalent, offers on the cheap later in order to pouch the difference. To own Muslims inside the low-Islamic countries, guaranteeing assets line up having Sharia laws is crucial. It goes past monetary information; it’s an union so you can keeping moral and you will religious criteria throughout monetary deals.

Concurrently, Islamic membership may charge a commission otherwise apply a great markup for the the fresh wide spread to make up for the attention-free character of the account. That way, while you are an agent, your create money as opposed to violating Islamic money prices. Additionally, it would appear that these types of trade is actually “imaginary” and figurative, since the individual will not individual nor does the guy have from the at any time hands of your foreign exchange that he’s trade. In the Forex trading, people obtain huge amounts of currency to buy the new Forex business, and that will bring damage to both the individual plus the cost savings within the general. Since the currency costs are constantly changing, they make an income if the money they ordered motions upwards up against the currency they marketed. In this article, we’re going to speak about This market and you may whether it is Haram or haram within the Islam from the white away from fatwas from the spiritual students.

Far more Solutions…

Inside Islamic membership, traders can be engage in commodities change, along with assets such gold, gold, and you will oils, if you are adhering to principles out of fairness and ethical conduct. Indices one echo business fashion due to a collection of holds and you can stock trading lined up which have enterprises pursuing the Islamic beliefs are also permissible. Really, Islamic profile allow investors to explore diverse locations when you are making sure its trade items stay static in balance with the religious philosophy.

Within framework, of numerous supporters away from Islam ask yourself if stepping into The forex market is halal (permissible) or haram (forbidden) with respect to the principles of Islamic Fund and the teachings from the brand new Holy Quran. To provide a definitive solution to that it concern, i delve strong on the Islamic jurisprudence, financial principle, and you will financial analytics. Additionally, Islamic finance encourages the idea of fairness and you can fairness inside the financial purchases.

This permits Muslim investors to participate in this market rather than violating the rules away from riba. This market involves the selling and buying out of currencies on the reason for making money regarding the motion within replace cost. Which introduces inquiries certainly Muslim traders as it can getting sensed since the a kind of betting otherwise speculation. Yet not, it is very important to tell apart between this market and gaming to help you dictate its conformity which have Islamic beliefs.

The brand new legality out of the forex market varies international, with a lot of countries making it possible for they although some impose certain legislation. Countries both embrace they in order to promote financial progress or control they to make sure industry integrity. Muslim people in addition to browse the religious prices when you are entering fx exchange. The newest complex interplay of courtroom architecture, monetary factors, and social sensitivities underscores the brand new varied surroundings away from the forex market.

Venture capital 101: A guide to Performing an investment capital Fund

Which desire is generally billed on the ranking which aren’t finalized by the end of one’s change go out. Of a Shariah direction, earning or using for example focus is considered riba which forbidden. To decrease the newest part of gharar, Muslim investors are advised to follow certain values inside their this market points. Firstly, they must stop too much conjecture or high-chance trade procedures which can cause uncertainty and you may possible losses. Instead, they have to focus on much time-term assets, standard research, and you can risk management solutions to eliminate the brand new part of gharar. Out of a technical view, the forex market doesn’t require the new percentage otherwise bill interesting.

To close out, this market is deemed halal below Shariah laws for as long since it abides by the guidelines away from equity, visibility, plus the lack of riba, gharar, and maysir. Muslim traders is to make sure they normally use reputable forex brokers that offer legitimate Islamic trade membership and comply with Shariah principles. At the same time, traders will be do this market with correct education, research, and you will exposure administration to stop playing-for example conclusion. Because of the knowing the Shariah legislation perspective for the forex trading, Muslims can also be participate in it international business while you are leftover in the boundaries of their religious thinking. Next aspect to consider is the exposure away from gharar otherwise uncertainty within the forex trading.

Qabd functions as a pillar from moral business strategies to quit exploitation and you will promote equivalence inside the commercial transactions. Shariah laws is the courtroom framework based on the brand new theories out of the new Quran and the Hadith (sayings and you may actions of your Prophet Muhammad). It controls every aspect away from an excellent Muslim’s life, as well as financial deals. So that one financing getting experienced halal, it will conform to particular values, for instance the absence of riba (usury otherwise attention), gharar (suspicion or ambiguity), and maysir (gambling). These values make an effort to make certain equity, visibility, plus the lack of exploitation within the financial transactions. Furthermore, transparency and equity are very important within the this market to possess Muslim traders.