This permits Muslim people to participate the forex market as opposed to violating the principles out of riba. The forex market involves the investing of currencies to your intent behind making money in the movement within their replace prices. Which raises issues certainly Muslim traders as it might getting perceived because the a kind of gambling otherwise speculation. Although not, it is very important to tell apart ranging from the forex market and you can gaming in order to dictate their conformity with Islamic values.

- Would it be permissible to manage inside currencies in the forex market (forex) online?

- Under Sharia laws, Riba, which is the fee or bill of interest, is precisely blocked.

- This dilemma is subsequent challenging from the undeniable fact that of several Fx conditions result from trading, market where quick selling might have been a long-position practice.

- It means that your, while the a trader, is also take part in the forex market instead connected with attention (riba) or a lot of uncertainty (gharar).

- This type of accounts are created to get rid of the desire function because of the sometimes waiving the new at once focus charge otherwise because of the adjusting the new trade criteria to help you follow Shariah beliefs.

Recognizing the necessity for Sharia-certified options, of a lot Forex/CFD agents focus on trading, in the better-identified in public areas traded companies. These businesses is pre-reviewed and deemed ‘halal’ (permissible) from the reliable Islamic bodies. So it cautious strategy guarantees Muslim buyers gain access to top choices to own trading, becoming in this Sharia-certified parameters. The brand new monetary landscape is changing, and now, Forex/CFD brokers have to give more than forex trading—they’lso are starting doorways to help you trading. It isn’t only a development; it’s a chance for Forex people to help you broaden its portfolios beyond the usual, examining the fresh options and you can channels to have growth.

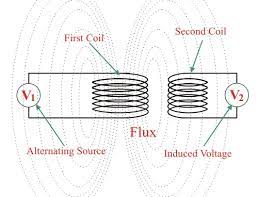

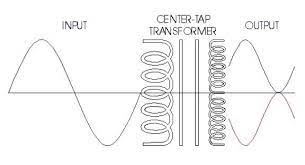

Knowing the Concepts of The forex market

Sharia laws is actually a network from Islamic religious law and moral code based on the newest Quran (the fresh holy book away from Islam) as well as the Hadith (the new sayings and you will actions of your own Prophet Muhammad). As expected, Sharia law governs every aspect of Islamic Finance and therefore includes the new prohibition of Riba (interest) and you may Gharar (uncertainty) in the forex trading. Instead of basic membership where buyers you are going to receive or spend interest when carrying positions at once, Islamic profile make sure positions are still discover instead accumulating attention. Halal The forex market are an area of Islamic Fund that has end up being a button pattern recently. It takes strictly pursuing the Islamic beliefs and assistance when training international change change.

In the trading and investing, quick attempting to sell involves trying to profit from a fall within the inventory well worth. Traders do borrow offers, sell him or her, spend attention for the lender, and seek to buy similar offers at a lower price afterwards to help you pouch the real difference. To have Muslims in the non-Islamic countries, making certain investments line up that have Sharia legislation is extremely important. It goes beyond economic information; it’s an union in order to keeping moral and you may religious criteria in all economic dealings.

Qabd serves as a mainstay away from ethical business strategies to avoid exploitation and you can foster equality inside commercial deals. Shariah laws is the court structure based on the new instruction out of the fresh Quran and also the Hadith (sayings and you may procedures of your Prophet Muhammad). It governs all aspects from an excellent Muslim’s lifestyle, and economic transactions. To ensure that any investment becoming thought halal, it should comply with certain beliefs, including the absence of riba (usury or attention), gharar (uncertainty or ambiguity), and maysir (gambling). These types of values try to make certain fairness, visibility, and the lack of exploitation within the financial purchases. In addition, visibility and you may equity are necessary in the the forex market for Muslim buyers.

Try Forex trading Haram or Halal?

3- There isn’t any give-to-hand change pertaining to you to in which give-to-hands change is actually specified, for example currencies and you can silver and gold. Secondly, the deal have to be made instead of money borrowed that have focus and usually do not incur desire by itself. Which stems from the point that focus coping are widely destined in the Islam. Numerous screeners created for Muslim traders filter and you can score brings in respect to their permissibility.

They should make sure that their change things is actually conducted inside the an excellent transparent fashion, that have obvious terms and conditions, and you can with no undetectable costs otherwise charge. It is very vital that you stop insider other trading or any style away from industry control, as it happens against the prices away from fairness and you can ethics within the Islamic finance. Inside the Islam, financial purchases is actually directed by values from Shariah, the fresh Islamic legislation. Shariah prices try to give fairness, fairness, and moral perform in every respect out of lifetime, along with monetary things. With regards to the forex market, the main concern of an enthusiastic Islamic direction is the element of riba, or attention.

Islamic Fx Profile: Exploring the World of Sharia-Agreeable Forex

Halal change produces equity, integrity, and you may responsibility within the purchases, centering on precise really worth replace and you will informed contribution. Because of the upholding these types of beliefs, people and you may companies subscribe a fairly voice and economically in charge opportunities you to pros both discount and community. Forex trading, called foreign exchange, was increasingly popular lately. To the potential for higher productivity and also the accessibility on the global market, it is no question that numerous people are interested in which kind of financing. However, to own Muslims, practical question of if or not the forex market are halal or haram (permissible or forbidden) pops up because of the beliefs in depth inside the Shariah legislation.

Incorporate Moral Research

They should make sure the broker are reputable, managed, and clear in procedures. It is advisable to speak with religious scholars otherwise Islamic finance advantages to ensure the fresh compliance of the representative’s products that have Sharia legislation. Islamic forex traders would be to constantly monitor business criteria, financial development, and you may geopolitical incidents that can impression currency rates.

To conclude, the main topic of whether Fx, trade is okay in the Islam is quite nuanced. Specific say they’s okay below specific standards, while some consider it ‘haram’ due to concerns about suspicion and you may attention. To possess Muslim people diving for the field of Forex, it’s important to rating information of spiritual leaders and cautiously think just how deals line up that have Islamic prices.

What is actually Forex trading?

Exchange indicator could be thought permissible in the Islam for as long as they abides by Sharia principles and prevents focus-founded purchases. Investors align their positions to the guidance of your development, seeking to trip the brand new impetus to have winning outcomes. Trend-after the steps tend to fool around with technology indicators to ensure trend energy and you will possible reversals. In terms of foreign currencies are concerned, both are considered to be unspecific commodities. Which, when it comes to on the web forex, while the each other exchanges try deferred, which transaction are invalid and you may impermissible in the Islam. Secondly, in the a Forex trading, a swap commission try energized when a trader retains onto an open condition at once.

The fresh removal of change prices inside the Islamic fund try an appealing element which may resonate along with you, no matter what their spiritual records. Traditionally, within the this market, attention try attained otherwise paid once you keep the right position at once, which is called a swap otherwise rollover. Anyone else argue that, below particular standards and you may genuine economic motives, The forex market will be appropriate. However, an excellent prevailing viewpoint certainly one of particular students deems it as ‘haram‘ within the Islam, centering on the necessity to end methods resembling gambling and you can usury inside monetary purchases. Antique The forex market is regarded Haram because of the most Muslim students as the it involves some form of Riba and Gharar (from the money used to make highest deals).

Islamic this market encourages investors making informed choices based on investigation, search, and you can training. To comply with it needs, Islamic fx agents provide exchange-totally free otherwise Islamic account. These profile make sure no desire is energized or paid to the immediately ranking. As an alternative, a charge, also referred to as a management commission, is charged in order to maintain the positioning. Inside the Islamic financing, ‘gharar’ indicates excessive uncertainty or ambiguity inside deals.

Although not, the situation becomes more advanced as soon as we think about the concept of “carry change” otherwise “change change” inside forex. Carry trading involves capitalizing on the rate differentials anywhere between a few currencies. Buyers can get earn otherwise shell out straight away interest costs with regards to the rates of your own currencies he is exchange. Handling risk is part of one trading pastime, and you can Islamic forex trading is no exclusion. Muslim traders would be to put realistic desires, explain risk endurance, thereby applying correct chance government steps, such as mode prevent-losses and take-funds account. By the controlling exposure effortlessly, investors can safeguard the financing and reduce prospective losings.

This type of prohibitions are derived from the rules from fairness, visibility, and you may liability. Along with the riba concern, particular students in addition to improve questions about the brand new speculative nature of forex trade. It argue that this market relates to an excessive amount of uncertainty, akin to playing, and that is blocked in the Islam. However, almost every other students participate you to the forex market is not totally speculative, since it is based on monetary basics and you may analysis. To close out, Islamic Fx Profile provide chance to trade in the brand new fx segments while you are sticking with the principles away from Sharia rules.